Are you looking to stay ahead in the stock market by investing in Tesla stock? Whether you’re a seasoned investor or just starting out, keeping track of the latest market trends, expert opinions, and forecasts is critical. FintechZoom Tesla Stock provides all the tools and insights you need to navigate Tesla’s performance in the stock market.

Tesla Inc. (NASDAQ: TSLA), led by Elon Musk, continues to be one of the most closely followed stocks globally. From groundbreaking innovations in electric vehicles (EVs) to its ventures in renewable energy, Tesla offers both opportunities and challenges for investors. FintechZoom is here to ensure you stay informed and make smart investment decisions.

What is FintechZoom Tesla Stock?

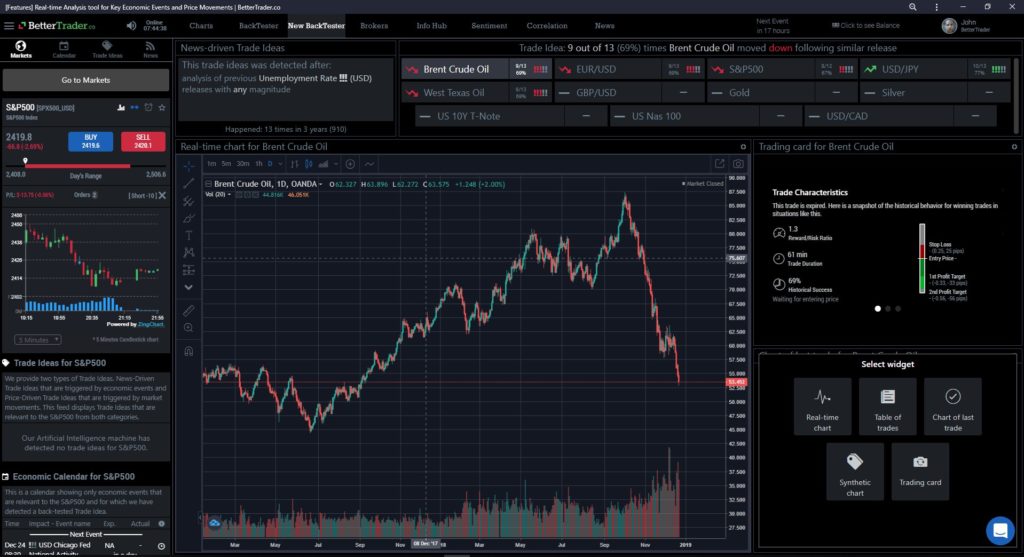

FintechZoom Tesla Stock is a dedicated section on the FintechZoom platform that provides real-time stock analysis, breaking news, price updates, and forecasts related to Tesla’s stock. It caters to a global audience of retail and institutional investors.

Key Highlights:

- Ticker: TSLA (Listed on NASDAQ)

- Focus: Electric vehicles, solar energy, and energy storage

- Milestones: Joined the S&P 500 in 2020, released industry-changing models like the Model S and Model 3

Tesla stock is a favorite for growth investors but is also known for extreme volatility driven by:

- Market sentiment

- Innovation updates

- CEO Elon Musk’s statements

Key Features of FintechZoom Tesla Stock – Inside Look!

- Real-Time Data:

Access live Tesla stock prices, updated every second to track market trends. - Market Analysis:

Get detailed reports on Tesla’s valuation, technical indicators, and growth potential. - Breaking News:

Stay updated with announcements, earnings reports, and market-moving events. - Expert Opinions:

Gain insights from analysts on Tesla’s stock trajectory and target price expectations. - Investment Tools:

Utilize advanced tools such as historical charts, stock performance comparators, and AI-driven projections

Read More: Fintechzoom Amc Stock – Essential Analysis Savvy Investors!

Tesla’s Stock Performance – A Brief History!

Tesla has come a long way since its IPO in 2010, with significant milestones shaping its stock price over the years.

Tesla Stock Price Trends:

| Period | Key Events | Impact on Stock Price |

| 2010-2015 | Tesla went public at $17 per share. Launch of Model S in 2012 boosted market confidence. | Gradual increase in stock price. |

| 2016-2019 | Introduction of Model 3 (2017) made Tesla the leader in EV production. | Record growth and rising investor confidence. |

| 2020-2024 | Joined S&P 500, achieved production milestones. Faced supply chain disruptions and growing competition. | Rapid growth with occasional volatility. |

Should You Buy or Sell Tesla Stock?

Investing in Tesla requires careful consideration of both its strengths and risks. Here’s a breakdown:

Why Buy Tesla Stock?

- Innovation: Leading in EVs, AI, and renewable energy technologies.

- Brand Loyalty: Strong customer base and global recognition.

- Sustainability: Riding the global trend toward clean energy.

Why Sell Tesla Stock?

- Volatility: Rapid price swings can lead to significant losses.

- Competition: Rivals like Rivian, Lucid, and traditional automakers are entering the EV market.

- Production Challenges: Supply chain issues may impact future growth.

Read More: 9781071826904 Table 12.2 – Boost Your Digital Marketing!

Why Tesla Stock Remains Popular in 2024?

Tesla continues to captivate investors for several reasons:

- Innovation in EVs: Tesla dominates the EV market with its Model S, 3, X, and Y vehicles, and upcoming models like the Cybertruck.

- Sustainability Push: As the world moves toward renewable energy, Tesla’s solar and energy storage products are gaining traction.

- Global Expansion: New Gigafactories in key markets like Germany, China, and the U.S. boost production capacity.

- Financial Performance: Despite macroeconomic challenges, Tesla has consistently delivered robust revenue growth and profitability.

How FintechZoom Helps Tesla Investors?

FintechZoom’s tools are tailored for investors looking to track Tesla stock effectively. Here’s how you can make the most of its features:

Tips for Using FintechZoom:

- Track Real-Time Data: Monitor live stock prices, trading volumes, and bid-ask spreads to stay informed.

- Set Price Alerts: Get notified when Tesla’s stock hits specific price points.

- Access Expert Analysis: Read forecasts and insights to help predict future movements.

- Review Historical Charts: Analyze past performance to inform long-term investment strategies.

Tesla Stock vs. Other EV Stocks

Tesla isn’t the only player in the electric vehicle (EV) market. Here’s how it compares with competitors:

| Competitor | Strengths | Tesla’s Advantage |

| Rivian (RIVN) | Focused on electric trucks. | Broader product range and stronger brand. |

| Lucid Motors (LCID) | Luxury EVs like Lucid Air. | More affordable options and larger market. |

| Traditional Automakers | Established supply chains, lower costs. | Tesla leads in innovation and technology. |

Is Tesla Stock a Good Investment in 2024?

Investing in Tesla stock comes with its share of pros and cons. Here’s what investors need to consider:

Pros:

- Strong Growth Potential: Tesla’s leadership in the EV market gives it a first-mover advantage.

- Technological Edge: Innovations in AI, battery technology, and renewable energy give Tesla a competitive edge.

- Global Brand Power: Tesla’s reputation ensures demand remains high across markets.

Cons:

- Valuation Concerns: Tesla’s high PE ratio may indicate the stock is overvalued.

- Competition: Rivals like Rivian, Lucid, and traditional automakers are entering the EV space aggressively.

Key Developments – Impacting FineTechZoom Tesla Stock in 2024!

Tesla is always in the spotlight, and 2024 is no exception. Here are some of the top developments investors need to watch:

- Launch of the Cybertruck: Tesla’s futuristic Cybertruck is finally hitting the market, and its success could significantly boost sales and revenue.

- Advances in Full Self-Driving (FSD): Tesla’s progress in autonomous driving technology remains a game-changer, attracting both tech enthusiasts and investors.

- Scaling Renewable Energy Solutions: From solar panels to Powerwall batteries, Tesla’s energy business is becoming a key revenue driver.

- Global EV Competition: With companies like Rivian, Lucid, and traditional automakers entering the EV market, Tesla faces increasing competition, pushing it to innovate further.

Read More: Www. Disquantifiedorg – Transforming Data Into Clarity!

Future of FineTechZoom Tesla Stock – What Lies Ahead?

Tesla’s future holds immense promise, driven by innovation and global trends, but it also faces significant challenges. As global adoption of electric vehicles (EVs) accelerates, Tesla is strategically positioned to lead, with an ambitious goal of producing 20 million vehicles annually by 2030.

Beyond vehicles, the company’s advancements in autonomous driving technology and its AI-powered Tesla Bot hint at potential new revenue streams that could redefine its market presence. While analysts remain divided on Tesla’s stock trajectory, its relentless focus on scaling production and driving innovation positions it as a strong contender for future growth.

What Experts Say About Tesla Stock?

Analyst opinions on Tesla stock vary widely. While some believe Tesla is poised for even greater growth, others highlight the risks of its high valuation and market competition. Notable projections include:

- Bullish View: Optimistic analysts see Tesla reaching $XXX per share within the year, driven by strong delivery numbers and new product launches.

- Bearish View: Critics argue that Tesla’s stock is overvalued, with a potential correction bringing prices closer to $XXX.

TIP: Tesla remains a strong contender, but careful timing and research are essential for maximizing returns.

FAQs:

How Reliable Are FintechZoom’s Tesla Stock Predictions?

FintechZoom uses technical analysis and expert opinions to provide forecasts. While predictions are data-driven, stock markets remain unpredictable, so use them as part of a broader investment strategy.

Should I Invest in Tesla Stock?

Tesla stock is suitable if you believe in the long-term growth of the EV and renewable energy markets. Assess your risk tolerance and consult expert predictions on FintechZoom before investing.

Can I Track Tesla’s Historical Stock Performance on FintechZoom?

Yes, FintechZoom offers historical charts showing Tesla’s stock performance over time, helping investors identify trends and make informed decisions.

Conclusion:

Tesla stock continues to capture the imagination of investors worldwide, thanks to its innovation, strong brand, and market leadership. With FintechZoom as your trusted resource, you’ll have access to the latest updates and tools to make well-informed decisions.

Whether you’re a seasoned investor or just starting out, keeping an eye on Tesla’s developments is essential. Stay tuned to FintechZoom Tesla Stock for all the information you need to stay ahead in 2024.

Read More: Izonemedia360 – Ultimate Platform For Digital Marketing!